Annual Report 2022

Kirk Kapital

Published in April 2023 by Kirk Kapital

Photos: PressConnect, Anders Sune Berg & Milestone Event – Jesper Sunesen

Concept and Design: Sunrise A/S

Fjordenhus, Havneøen 1

DK-7100 Vejle

+45 33 44 50 00

www.kirkkapital.dk

info@kirkkapital.dk

Company reg. (CVR) no. 31159857

Annual Report for 1 January - 31 December 2022

The Annual Report was presented and adopted at the

Annual general meeting of the company on 25 April 2023.

01 Welcome to Kirk Kapital 07 Our Heritage 08 What We Do 12 2022 at a Glance 14 Financial Highlights 03 Board & Management Composition 32 Board of Directors & Executive Management 02 Our Business Activities 18 Activities Overview 20 Strategic Investments 24 Financial Investments 26 Vejle Investments 28 Business & Financial Risk 04 Financial Statements 36 Comprehensive Income Statement 37 Balance Sheet Statement 38 Changes in Equity Statement 39 Cash Flow Statement 40 Notes 68 Management’s Statement 70 Independent Auditor’s Report 05 ESG 78 Letter from CEO 82 Kirk Kapital’s ESG Framework 83 ESG within Investment Activities 85 Strategic Investments 86 Financial Investments 88 Inside Kirk Kapital Annual Report 2022 ESG Report 2022

01 Welcome to Kirk Kapital

6 Annual Report Welcome to Kirk Kapital

Our Heritage

Continuing the legacy of Lego

1932 was the year Ole Kirk Christiansen began crafting wooden toys in his modest workshop in Billund. By 1934 he had begun selling toys under the now world-famous name LEGO. Persevering through many setbacks, the business eventually blossomed into what it is today – the world’s most successful toy company. This is the heritage of Kirk Kapital. Today, almost 90 years later, this same perseverance, imagination and ingenuity is what forms the foundation of Kirk Kapital’s business activities.

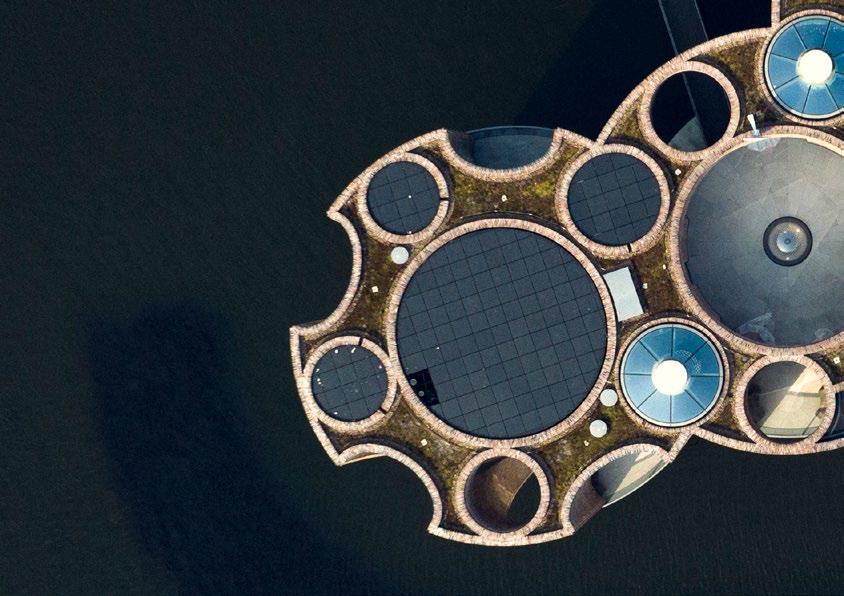

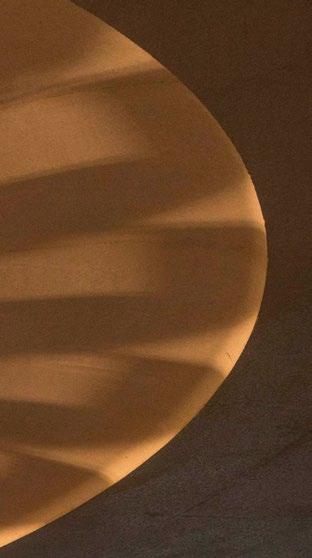

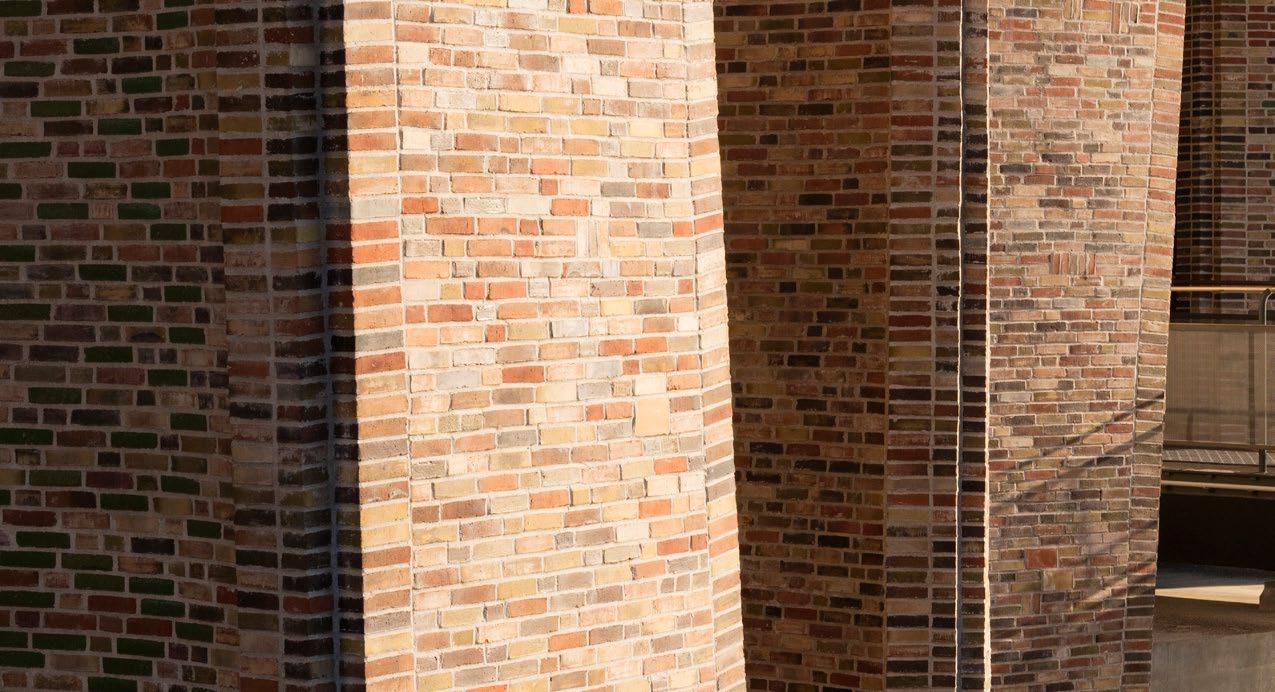

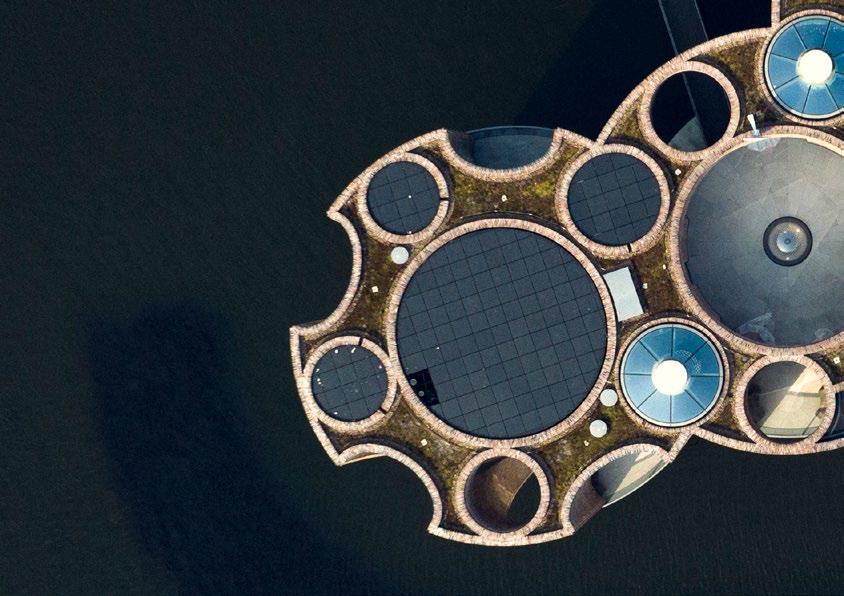

Rooted in Vejle

In 2007, the Kirk Johansen family parted from Kirkbi A/S, and consequently LEGO, in order to establish their own investment activities and organisation through Kirk Kapital. Our shareholders, and Kirk Kapital, are deeply connected to the area in and around the city of Vejle. A manifestation of our respect and commitment to the city of Vejle is Fjordenhus. Fjordenhus both serves

as the headquarter of Kirk Kapital, but, more importantly, is a towering work of art that greets all visitors to Vejle created by the world-famous artist Olafur Eliason.

Partnering with family and companies

In connection with the launch of a new investment strategy, Kirk Kapital established a second office in Copenhagen in 2017, and expanded the organisation. In 2020, a fully owned Kirk Kapital subsidiary obtained a license with the Danish FSA, legally enabling us to manage other families’ wealth also. Today, Kirk Kapital specialises in making strategic minority investments in tomorrow’s best companies as well as managing multiple financially invested portfolios, uniquely tailored to the families we serve.

Descendants of a pioneer

Our shareholders are the Kirk Johansen families, who are Ole Kirk Christiansen’s descendants.

7 Annual Report Welcome to Kirk Kapital

What we do

Family first

At Kirk Kapital, our purpose is to create long-term prosperity for the families of our shareholders, partners, and employees. We manage and grow family-owned capital, based on strong family values. Family is very important to us, and it provides a solid foundation for business, while highlighting the importance of family life outside work. These values inspire a strong sense of belonging – not just internally, but also among the companies and families with whom we partner. Every one of our partnerships is built on trust, responsibility, and a longer-term commitment. We are proud of these tight bonds and collaborations.

Focused on success

Founded in our family DNA, our key values are Competence, Dedication, and Integrity. At Kirk Kapital, we serve our purpose by having a relentless focus on being among the best at what we set out to do, while operating

with the highest standards of professional behaviour and ethics. The latter also evidenced by our Environmental, Social, and Governance (ESG) ambitions, which now form an integral part of our overall long-term ambitions. All our investment activities are centred around our motto: “Invest, Collaborate and Create”. Our main investment activity is centred around our two divisions: Strategic Investments and Financial Investments.

Our scope: Scandinavian medium and larger-sized companies

Within Strategic Investments, Kirk Kapital invests in larger minority shareholdings (25-50%) in companies while applying an active ownership agenda through board representation. Our strategic investment scope is Scandinavian medium and larger-sized companies that have unique, market-leading positions in longterm growth industries. Currently, the portfolio includes 16 companies.

8 Annual Report Welcome to Kirk Kapital

The highest quality wealth management

Through Kirk Kapital Fondsmælgerselskab A/S, which is regulated by the Danish FSA, Kirk Kapital manages multiple individual portfolios, where each portfolio is tailored to our partners’ precise requirements and wishes. The portfolios consist of a wide range of investments including fixed income, listed equities and alternatives. Our independency, as well as combined assets-under-management size, provide our families with the highest quality wealth management services while maintaining cost efficiency. Currently, we manage 20 portfolios, including Kirk Kapital’s own Financial Investments portfolio.

Committed to Vejle

As a supplement to our main investment activities, Vejle Investments holds our investment activities centred around the city of Vejle. These are mainly real estate investments in Fjordenhus, Utoft Plantage and Havneøen. Our strategic scope is to provide continued support to Fjordenhus and Utoft Plantage, thus maintaining our roots in Vejle and our commitment to forestry and wildlife.

9 Annual Report Welcome to Kirk Kapital

10 Annual Report Welcome to Kirk Kapital

“ At Kirk Kapital, our ambition is to do our part in helping to build a better world.”

Kim Gulstad, CEO

11 Annual Report Welcome to Kirk Kapital

2022 at a Glance

Consistent progress

2022 was a year of continued progress for Kirk Kapital. We spent it delivering on our long-term strategy and our purpose of creating long-term prosperity for the families of our shareholders, employees, and partners.

An extraordinary investment year

2022 was truly an extraordinary year in the financial markets. Global publicly listed shares lost 14% while Nasdaq lost 33% (both in DKK), losses not seen since the financial crisis in 2008. Simultaneously, both Danish government bonds and Danish real estate mortgages lost 20%. Hence, 2022 proved to be a truly challenging year for the financial markets. In light of this exceptionally challenging environment, I am very proud and humbled to state that our investment result in 2022 was DKK 1.6 billion. This is – once again – a record result in the history of Kirk Kapital.

Since the launch of our revised strategy in 2017, Kirk Kapital has in the 5-year period between 2018 – 2022 generated a total investment result of DKK 4.6 billion, or an average 13% equity return, while paying out aggregated dividends of DKK 262 million. At the end of the period, the equity value was DKK 8.1 billion.

Strong results from Strategic Investments

The 2022 result was derived from an exceptionally strong result from our Strategic Investments, which gained one-off support from re-valuations from several partial divestitures. Our Financial Investments delivered a smaller negative result, which we consider satisfactory, not least considering the general market developments.

The financially invested portfolios Kirk Kapital managed on behalf of external families depicted a similar picture as Kirk Kapital’s own financially invested portfolio. We continue to further enhance the quality and cost effectiveness of our service. At the end of the period, the external assets-under-management totalled DKK 5.5 billion.

Tour de France

The start of the third stage of the Tour de France took place at Kirk Kapital’s Havneøen in Vejle. We were both pleased and proud to be able to make the square available, enabling the whole world to see what the city of Vejle has to offer. Furthermore, we also

12 Annual Report Welcome to Kirk Kapital

co-sponsored a permanent art installation celebrating the Tour de France’s start in Vejle. Kirk Kapital took the opportunity to invite shareholders, employees, friends, and families to celebrate this unique event at Fjordenhus.

Progress on ESG

I am proud that Kirk Kapital is a UN Global Compact signatory. Simultaneously with the 2022 Annual Report, we are publishing our 2022 ESG Report. ESG has now become an integral part of our strategy and is embedded throughout our internal operations and investment activities.

Internally, we are focussing on UN SDG 5 (gender equality), 8 (decent work and economic growth), 13 (climate action), and 16 (peace, justice, and strong institutions). During 2022, we have, for example, improved parental leave conditions, taken the initiative to map Kirk Kapital’s CO₂ footprint, and identified concrete initiatives to decrease it. I am especially proud to see that our employee satisfaction scores in our annual surveys continues to be high.

Looking forward to 2023

In summary, 2022 has been a fantastic year, both when it comes to our financial performance, which was significantly above our expectation going into 2022, and our progress on our long-term strategy.

For 2023, we expect a positive investment result of DKK 450 million or above. This is assuming financial returns in line with our long-term market forecasts. However, considering the continued high volatility on the financial markets, the assumption is associated with significant risk. In past years, we have seen significant deviation from the expected investment result.

No events have occurred after the balance sheet date which are considered to have a material impact on the assessment of the Annual Report.

14.4 DKKb Total

8.1 DKKb

13%p.a.

16

20

26

Kim Gulstad, CEO

Assets-Under-Management

Equity Value

Book

5-Year Equity Return

Portfolio Companies

Wealth Management Portfolios

Number of Employees 13 Annual Report Welcome to Kirk Kapital

Financial Highlights

Key Ratios 2022 2021 2020 2019 2018 Return on Equity 20% 22% 7% 14% 4% Solvency Ratio 90% 93% 88% 89% 91% Return on Invested Capital 22% 26% 9% 16% 4% Return on Invested Capital per Investment Catagory: Strategic Investments 38% 40% 14% 30% 16% Financial Investments (7%) 17% 6% 11% (4%) Vejle Investments 5% (18%) (8%) (8%) (9%)

14 Annual Report Welcome to Kirk Kapital

Income Statement DKK (millions) 2022 2021 2020 2019 2018 Strategic Investments 1,746 1,305 405 658 329 Financial Investments (160) 358 123 211 (61) Vejle Investments 18 (94) (44) (78) (68) Net Investment Result 1,604 1,569 484 791 200 Comprehensive Income 1,459 1,354 393 680 169 Balance Sheet DKK (millions) 2022 2021 2020 2019 2018 Strategic Investments 6,201 4,293 3,426 3,043 2,169 Financial Investments 2,294 2,511 2,152 2,108 1,748 Vejle Investments 429 377 517 467 930 Total Investment Assets 8,924 7,181 6,095 5,618 4,847 Total Assets 9,033 7,257 6,186 5,721 4,914 Total Equity 8,140 6,749 5,450 5,108 4,474 15 Annual Report Welcome to Kirk Kapital

02 Our Business Activities

Activities Overview

Key Activities

Strategic Investments

Investment Activities

Financial Investments

Vejle Investments

Family Office

• Larger minority positions (25-50%) in Scandinavian medium- and larger-sized companies having marketleading positions in long-term growth industries

• Active long-term minority owner

• General wealth management across asset classes

• Asset allocation

• Discretionary Portfolio Management

• Predominantly holds our investment activities centered around the city of Vejle

• Mainly real estate investments in Fjordenhus, Utoft Plantage and Havneøen

• General assistance and advice in relation to finances, tax, bookkeeping, administration, etc.

• Property administration and maintenance

18 Annual Report Our Business Activities

Kirk Kapital’s Investments

Financial Investments

Strategic Investments % (excl. client’s managed funds) Cash 5% Equities 37% Fixed Income 15% Alternatives 43% 5% 70% 25% 19 Annual Report Our Business Activities

Vejle Investments

Strategic Investments

Tomorrow’s best companies

Kirk Kapital acquires larger minority shareholdings (2550%) in companies, while applying an active ownership agenda through board representation. Our strategic investment scope is Scandinavian medium- and larger-sized companies that have unique and market-leading positions in long-term growth industries. Furthermore, our focus concentrates on business-to-business companies that offer either a service or a product, based on a capital light asset setup. In other words, Kirk Kapital invests in tomorrow’s best companies.

requirements and precise needs. Altogether this creates the best conditions for each company’s long-term successful development.

Taking a sustainable perspective

Dec. 2022

A tailored approach

Rooted in our family values, we have continued our structured work on ESG. We utilise our internally developed ESG compass throughout our investment process. Sustainability is an integral part of the due diligence process when acquiring new companies, and a sustainability board engagement policy has been implemented which all Kirk Kapital representatives are obliged to follow.

Currently, the portfolio includes 16 companies. In 2022, we added Promon, Cookie Information and Mobilhouse to our portfolio. Promon is a global, market-leading provider of next generation application-shielding software. Cookie Information is the 70% Share of Assets

Kirk Kapital’s unique model for active minority investments ensures the independence of our partners while supplying the best possible conditions for their lasting success. We achieve this by providing active board representation, the benefits of our toolbox, and shared best practice across our portfolio. Common to all cases is a tailored approach, finely calibrated to our partners’

Additions to the portfolio

20 Annual Report Our Business Activities

Scandinavian market-leading provider of consent solutions for websites that ensure GDPR compliance. Mobilhouse is a Danish market-leading provider of temporary modular buildings. Simultaneously, we led the formation of a new ownership consortium in FeMD, in which, going forward, we will own 40% of the company while ATP and Lundbeckfonden will each own 30%. Thereby, Kirk Kapital increased its ownership stake from 30% to 40%. Finally, we have reduced our shareholding in Scanmetals from 38% to 33%, where Core Sustainability Capital has been invited in as a new 33% shareholder. All in all, 2022 has been a good year with abnormally high transaction activity.

Results speak for themselves

Our investment result in 2022 is DKK 1,746 million, or 38% return, and the asset value by year-end is DKK 6,201 million. The aggregated investment result over the past 5 years is DKK 4,443 million, or 27% p.a. return. The result in 2022 is positively impacted by several one-off value adjustments, and in this light, the result is significantly above our expectations. The result over the past 5 years is also well above our long-term result expectations. 16

Return 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 60 55 50 45 40 35 30 25 20 15 10 2,169 3,043 3,426 4,293 6,201 2018 2019 2020 2021 2022 DKK (millions) %

Development in Assets and

Portfolio Companies

UN Global Compact Signatories

DKKb Aggregated Revenue

2

+11

Employees Assets ROA 21 Annual Report Our Business Activities

+3,800 Aggregated Number of

Investments

World-leading manufacturer of quality playground equipment, outdoor fitness, and outdoor furniture designed to promote development through play and movement

Developer and manufacturer of innovative hemostatic products used by health care professionals in the fields of surgery and diagnostics globally

Software company providing Configure Price Quote (CPQ) solutions to global industrial, automotive, and pharmaceutical companies

World leader in packaging for processing of frozen fish blocks, frozen fillets, and breaded products within the white-fish industry

International provider of end-to-end solutions of foldable IBC containers, Bag-In-Box liners / bags, container fittings, filling, and emptying equipment

IT consultancy service company focusing on engaging top IT talent and offering services within Consulting, Infrastructure, Security, and Development

Aftermarket provider of used serviceable wheels and brakes for airlines worldwide offering a simple alternative to traditional component management

Leading int. rental company within cold storage solutions. Rental divisions incl. cold storage (Arctic Store®), ISO containers and self-storage sites across Europe and Australia.

Year of investment Stake Partner Revenue, ‘21 2014 27% Family DKKm 2,382 Year of investment Stake Partner Revenue, ‘21 2017 33% Private Equity DKKm 214 Year of investment Stake Partner Gross Profit, ‘21 2018 35% Management DKKm 80 Year of investment Stake Partner Revenue, ‘21 2019 26% Private Equity DKKm 583 Year of investment Stake Partner Revenue, ‘21 2019 30% Family DKKm 711 Year of investment Stake Partner Revenue, ‘21 2018 & 2021 26% Private Equity DKKm 326 Year of investment Stake Partner Gross Profit, ‘21 2018 40% Family Foundation DKKm 110 Year of investment Stake Partner Revenue, ‘21 2016 & 2022 40% Pension Fund & Foundation DKKm 720 22 Annual Report Our Business Activities

Leading European metal recycling company operating with innovative technology for optimal recovery and refinement of metallic waste

Largest Danish full-service monument company providing customers support from selecting the stone, designing, and engraving, to installation

Manufacturer of propagation systems, known as the Ellepot system, consisting of machines, specially developed and patented paper, and trays for growers worldwide

Danish Consent Management Platform providing cookie consent solutions for websites and mobile apps that ensure GDPR compliance for +3,000 customers

Scandinavian manufacturer of sustainable wood packaging solutions from standard pallets and takeaway boxes to packaging for wind turbine blades

Globally leading Norwegian manufacturer of high-quality omega-3 concentrates utilising state-ofthe-art production equipment

Software company providing next-gen application shielding software safeguarding applications, used on +300m devices globally, from malware attacks

Danish temporary modular buildings provider offering sustainable modular solutions for rent for a variety of purposes incl. office facilities and day care.

Year of investment Stake Partner Revenue, ‘21 2019 33% Management DKKm 902 Year of investment Stake Partner Gross Profit, ‘21 2020 45% Family & Owners DKKm 78 Year of investment Stake Partner Gross Profit, ‘21 2021 48% Family & Owners DKKm 67 Year of investment Stake Partner Gross Profit, ‘21 2022 40% Management DKKm 16 Year of investment Stake Partner Revenue, ‘21 2022 50% Management DKKm 116 Year of investment Stake Partner Revenue, ‘21 2022 34% Private Equity DKKm 69 Year of investment Stake Partner Revenue, ‘21 2021 32% Family DKKm 346 Year of investment Stake Partner Revenue, ‘21 2020 40% Management DKKm 1,372 23 Annual Report Our Business Activities

Financial Investments

Multiple portfolio management

Worldwide impact

25% Share of Assets

Dec. 2022

Kirk Kapital (through Kirk Kapital Fondsmæglerselskab A/S) manages multiple individual portfolios tailored to our partners’ precise needs. All portfolios managed consist of a wide range of investments including listed equities, fixed income, and alternatives. The largest portfolio is Kirk Kapital’s own Financial Investments portfolio of DKK 2,294 million. The external assets-under-management totals DKK 5.5 billion. Currently, we manage 20 portfolios.

A sustainable core

Based on our family values, we have continued our structured work on ESG. To do this we utilise our internally developed ESG Compass throughout our investment process and we have adopted the UN’s Principles for Responsible Investment. Furthermore, we have an ESG committee that continuously monitors and challenges our work.

2022 was truly an extraordinary year in the financial markets. Global publicly listed shares lost 14% while Nasdaq lost 33% (both in DKK), losses not seen since the financial crisis in 2008. Simultaneously, both Danish government bonds and Danish real estate mortgages lost 20%. From a macro point of view, this in part was driven by the war in Ukraine and globally strong inflationary forces. Hence, 2022 proved to be a truly challenging year for the financial markets. The impact of this turbulence was also visible in Kirk Kapital.

24 Annual Report Our Business Activities

Satisfactory results despite challenges

Kirk Kapital’s own Financial Investments portfolio generated an investment result of DKK -160 million, or -7% return, and the asset base by year-end is DKK 2,294 million. The negative result is due to challenging public market developments in both equities and fixed income. However, public market losses have been partially offset by a sound development in the alternative or private markets exposure. All in all, the 2022 result is satisfactory, despite the result being below our longterm return expectations.

The aggregated investment result over the past 5 years is DKK 471 million, or 4% p.a. return. This longer-term return is broadly in line with our longer-term return expectations.

20 Wealth Management Portfolios

90% External Managers who are UN PRI Signatories

58 Total Number of External Managers.

1,126 Total Number of Trades

Development in Assets and Return 3,000 2,500 2,000 1,500 1,000 500 0 30 25 20 15 10 5 0 -5 -10 -15 1,748 2,108 2,152 2,511 2,294 2018 2019 2020 2021 2022 DKK (millions)

in 2022. Excl. FX Assets ROA % 25 Annual Report Our Business Activities

Vejle Investments

5% Share of Assets Dec. 2022

Vejle in focus

Vejle Investments predominantly holds our investment activities centred around the city of Vejle. These are mainly real estate investments in Fjordenhus, Utoft Plantage and Havneøen. Our strategic scope is to maintain and develop Fjordenhus and Utoft Plantage, further strengthening our roots in Vejle and our commitment to forestry and wildlife.

Havneøen progress

In 2022, we completed the construction of the buildings Zleep Hotel and Kirk Suites on Havneøen. The construction of a building on the last available plot

on Havneøen is progressing as planned and is expected to be completed during 2023. This will finalise the Havneøen project, a project initiated more than 10 years ago. Kirk Kapital is proud of the outcome of this project and it testifies to our veneration of and commitment to the city of Vejle.

Results in line with expectations

Our investment result in 2022 is DKK 18 million, and our net asset base by year-end is DKK 429 million. The result is positively impacted by a market value adjustment of an interest rate swap while the underlying result broadly is in line with our expectations.

26 Annual Report Our Business Activities

Development in Assets and Return 1,000 900 800 700 600 500 400 300 200 100 0 20 15 10 5 0 -5 -10 -15 -20 930 467 517 377 429 2018 2019 2020 2021 2022 DKK (millions) Assets ROA % 27 Annual Report Our Business Activities

Business & Financial Risk

Managing risk

As a family-owned business and investment company we are widely exposed to financial risks, especially those relating to market risk, with an exposure to publicly traded securities. Our three investment divisions are managing financial risks with the objective to create long-term prosperity for the families of our shareholders and business partners. In this light, we have not taken any significant risks that could be referred to as out of the ordinary, considering the extent of our activities as a business and investment company. For further information about financial risk management, refer to note 6 Financial Risk Management.

Other statutory statements

In accordance with Danish legislation, Kirk Kapital has prepared statutory statements in relation to gender under-representation in management, on data ethics and Corporate Social Responsibility which forms part of Kirk Kapital’s ESG Report. The report can be found in chapter 5 of this document.

28 Annual Report Our Business Activities

29 Annual Report Our Business Activities

03

Board & Management Composition

Board of Directors

Executive Management

Casper Kirk Johansen Chairman of the Board Anders Kirk Johansen Board Member Birgitte Nielsen Board Member Jens Moberg Board Member

Peter Beske Nielsen Board Member

Casper Kirk Johansen Chairman of the Board Anders Kirk Johansen Board Member Birgitte Nielsen Board Member Jens Moberg Board Member

Peter Beske Nielsen Board Member

32 Annual Report Board & Management Composition

Kim Gulstad CEO

“ Every one of our partnerships is built on trust, responsibility, and a longer-term commitment. We are proud of these tight bonds and collaborations.”

Kim Gulstad, CEO

33 Annual Report Board & Management Composition

04 Financial Statements

Comprehensive Income Statement

DKK (millions) Note 2022 2021 Strategic Investments 3 1,746 1,305 Financial Investments 4 (160) 358 Vejle Investments 5 18 (94) Net Investment Result 1,604 1,569 Other Operating Income 8 8 Expenses 7 (185) (158) Other Financial Income (8) (1) Comprehensive Income before Tax 1,419 1,418 Tax 9 40 (64) Total Comprehensive Income for the Year 1,459 1,354

36 Annual Report Financial Statements

Balance Sheet Statement

Assets DKK (millions) Note 2022 2021 Strategic Investments 3 6,201 4,293 Financial Investments 4 2,294 2,511 Vejle Investments 5 429 377 Lease Assets - Right-of-use Assets 65 68 Total Non-Current Assets 8,989 7,249 Tax Receivables 9 36 0 Other Receivables 8 7 Cash & Cash Equivalents 0 1 Total Current Assets 44 8 Total Assets 9,033 7,257 Equities & Liabilities DKK (millions) Note 2022 2021 Share Capital 11 100 100 Retained Earnings 7,958 6,581 Proposed Dividend for the Year 82 68 Total Equity 8,140 6,749 Other Payables 230 100 Lease Liabilities 66 69 Deferred Tax Liabilities 9 12 12 Total Non-Current Liabilities 308 181 Credit Institutions 6 547 146 Tax Payables 0 28 Other Payables 6 38 153 Total Current Liabilities 585 327 Total Liabilities 893 508 Total Equity & Liabilities 9,033 7,257 37 Annual Report Financial Statements

Changes in Equity Statement

Change in Equity Statement 2021 DKK (millions) Share Capital Retained Earnings Proposed Dividend Total Equity at 01.01.2021 100 5,295 55 5,450 Profit for the Period 0 1,339 0 1,339 Other Comprehensive Income 0 15 0 15 Total Comprehensive Income for the Period 0 1,354 0 1,354 Transactions with Owners in their Capacity as Owners: Ordinary Dividend Paid 0 0 (55) (55) Dividend 0 (68) 68 0 Total Dividend for the Period 0 (68) 13 (55) Equity at 31.12.2021 100 6,581 68 6,749 Change in Equity Statement 2022 DKK (millions) Share Capital Retained Earnings Proposed Dividend Total Equity at 01.01.2022 100 6,581 68 6,749 Profit for the Period 0 1,426 0 1,426 Other Comprehensive Income 0 33 0 33 Total Comprehensive Income for the Period 0 1,459 0 1,459 Transactions with Owners in their Capacity as Owners: Ordinary Dividend Paid 0 0 (68) (68) Dividend 0 (82) 82 0 Total Dividend for the Period 0 (82) 14 (68) Equity at 31.12.2022 100 7,958 82 8,140

38 Annual Report Financial Statements

Cash Flow Statement

Accounting policy

The cash flow statement shows the cash flows for the year broken down by other investing and financing activities, changes for the year in cash and cash equivalents as well as the company’s cash and cash equivalents at the beginning and end of the year.

Cash flows from other activities are calculated as the net comprehensive income for the year adjusted for changes in working capital and non-cash operating items such as depreciation, amortisation and impairment losses, and provisions. Working capital comprises current assets less short-term debt excluding items included in cash, investment activities and cash equivalents.

Cash flows from investing activities comprise net cash flows to and from the three investment portfolios.

Cash flows from financing activities comprise cash flows from the raising and repayment of long term debt as well as payments to and from shareholders.

DKK (millions) 2022 2021 Comprehensive Income for the Year 1,459 1,354 Adjustments - Net Investment Result (1,604) (1,569) Changes in Net Working Capital (50) 170 Net Cash Flow from Other Activities (195) (45) Cash Flow from Strategic Investments* (163) 444 Cash Flow from Financial Investments 52 6 Cash Flow from Vejle Investments (28) 43 Cash Flow from Investment Activities (139) 493 Proceeds from Credit Institutions 401 0 Repayment of Credit Institutions 0 (393) Dividend Paid (68) (55) Cash Flow from Financing Activities 333 (448) Net Cash Flow for the Year (1) 0 Cash & Cash Equivalents, Beginning of the Year 1 1 Cash & Cash Equivalents at End of the Year 0 1 *Gross cash flow from Strategic Investments were DKK 1,509 million in cash inflow and DKK 1,672 million in cash outflow. 39 Annual Report Financial Statements

Notes 01 Accounting Policies 04 Financial Investments 02 Critical Accounting Estimates & Judgements 05 Vejle Investments 03 Strategic Investments 06 Financial Risk Management 40 Annual Report Financial Statements

08 Staff Expenses 11 Share Capital 14 Fees to Auditors Appointed at the General Meeting 09 Tax 12 Commitments & Contingent Liabilities 15 Events after the Balance Sheet 07 Expenses 10 Related Parties 13 Investments in Subsidiaries & Accociates 41 Annual Report Financial Statements

01

Accounting Policies

Accounting policies

The financial statements are presented in Danish Kroner (DKK), as this is the company’s functional currency. The financial statements have been rounded to the nearest million.

The financial statements for Kirk Kapital have been prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB) and as adopted by the European Union as well as additional Danish disclosure requirements applying to entities of reporting class C for large enterprises.

Kirk Kapital has during the year changed its status to become an investment entity under IFRS 10 whereby it ceases to consolidate its subsidiaries. Besides this the accounting policies used are unchanged from last year.

Investment entity

Over the past 5 years Kirk Kapital’s operating activities within shipping and aviation have gradually been exited and are now less material. Kirk Kapital has therefore decided to change its status under IFRS to investment entity due to it having the following characteristic under IFRS 10.27:

• It holds funds from multiple investors

• Its business objective is to invest funds with the purpose of capital appreciation, profit on divestments and/or dividends

• Its investments are measured and evaluated at fair value

In accordance with IFRS 10 Kirk Kapital does not consolidate its subsidiaries and does not apply IFRS 3 when obtaining control over new investments.

42 Annual Report Financial Statements

The change does not have any impact on the 2021 year end result as the total comprehensive income for 2021 is unchanged at DKK 1,354 million. In brief, it has not materially affected the comprehensive income statement within line items net investment result DKK +28 million, other operating income DKK -30 million, expenses DKK -11 million and tax DKK +13 million.

Total assets and liabilities have decreased DKK 153 million – mainly debt with collateral and intercompany debt, offset in relevant asset values.

In statement of cash flow, then, cash position allocated to Financial Investments is considered an investment activity and not included in net cash positions as earlier years. Further, movements on intercompany balances are part of each investment category and are thus investment activity and not a change in working capital.

Foreign currency translation

Transactions and balances

Transactions in currencies other than the company’s functional currency are translated into the functional currency using the exchange rates at the dates of the transactions. Foreign exchange gains and losses resulting from the settlement of such transactions and from the translation of monetary assets and liabilities denominated in foreign currencies at year end exchange rates are generally recognised in profit or loss.

Comprehensive income statement

Other operating income and expenses

Other operating income and other expenses comprise items of a secondary nature to the main activities of the company.

Financial income and expenses

Financial income and expenses include interest, realised and unrealised exchange adjustments, price adjustment of securities, amortisation of mortgage loans.

Leases

The right-of-use asset and corresponding lease liability will be recognised at the commencement date, the date the underlying asset is ready for use. The lease terms may include options to extend or terminate the lease when it is reasonably certain that Kirk Kapital will exercise that option.

01 43 Annual Report Financial Statements

Depreciations are done following the straight-line method over the lease term or the useful life of the assets.

Kirk Kapital applies the short-term lease recognition exemption for lease contracts that, at the commencement date, have a lease term of 12 month or less for all classes of underlying assets, and the exception for lease contracts for which the underlying asset is of low value.

Right-of-use assets normally have the following lease terms:

Rental of Premises 1-30 years

Other Assets 1-5 years

Financial highlights

Explanation of financial ratios:

Equity at year-end x 100

Total Assets at year-end

Solvency Ratio = Return on Equity = The financial ratios have been computed in accordance with the latest guidelines issued by the Danish Finance Society.

Net Profit for the year x 100

Average Equity

01

44 Annual Report Financial Statements

Critical Accounting Estimates & Judgements

In the preparation of the financial statements according to IFRS, management is required to make certain estimates: those financial statement items that cannot be reliably measured must be estimated, as the value of assets and liabilities often depends on future events that are somewhat uncertain.

The judgments, estimates and assumptions made are based on historical experience and other factors that management considers to be reliable, but which by their very nature are associated with uncertainty and unpredictability. These assumptions may prove incomplete or incorrect, and unexpected events or circumstances may arise.

Critical accounting estimates

Financial assets are either measured at amortised cost or fair value through profit and loss. Assets and liabilities at fair values have been measured using either of the below three levels of fair value hierarchy:

Level 1:

Quoted prices in active markets for identical markets

Level 2:

Inputs other than quoted prices included within level 1 that are observable for the assets either directly or indirectly

Level 3:

Input for the liabilities and assets that are not based on observable market data. These fair value measurements are from either external portfolio managers or by management estimates using multiples from similar investments or using fair value calculations models such as DCF models.

For each investment category it is described which level of fair value hierarchy is used.

02

45 Annual Report Financial Statements

Strategic Investments

Accounting policy

Strategic Investments are defined as larger illiquid minority investments with an active ownership agenda. The portfolio is shown on page 22 & 23. The investments are owned through the subsidiary Kirk Kapital Strategic Investments A/S.

Realised and unrealised gains and losses on fair value adjustments are recognised in the comprehensive income statement in the financial year in which they arise. Realised gains and losses on sale of financial assets are calculated on the basis of the valuation beginning of the financial year. Purchase and sale of investments are recognised on trade date. Dividends from portfolio companies are assumed realised at fair value and thus wihout comprehensive income impact. Realised direct transaction costs and earnings are included under realised gains and losses. Indirect costs in Kirk

Kapital Strategic Investments A/S are included under expenses, net of any intercompany earnings and costs. The minority investments are recognised in accordance with IFRS 9 at fair value through profit and loss. The minority investments are initially recognised at fair value and subsequently adjusted to fair value. Dividends received from Strategic Investments are recognised as unrealised gains and losses.

Investment properties are recognised at cost comprising the acquisition price and costs of acquisition and subsequently measured at fair value. Other investment assets are mainly investments in aircraft together with other run-off investments which are recognised and measured under the equity method less any assets attributable to other investment categories. The underlying assets are measured at fair value.

Significant accounting estimates and judgements

Valuation of investments in Strategic Investments at fair value is based on estimates and assumptions as regards to the fair value of each individual company in the Strategic Investments portfolio, using valuation hierarchy 3. These investments amount to DKK 6,201 million in 2022 (DKK 4,293 million in 2021).

For the majority of the investments (DKK 5,897 million in 2022 and DKK 3,700 million in 2021), the fair value is primarily estimated using last-twelve-month valuation metrics (LTM Metric) and a valuation multiple. The value derived is adjusted for net interest-bearing debt (NIBD).

The LTM Metric and NIBD are based on normalised reported figures by the portfolio companies. The LTM

03

46 Annual Report Financial Statements

Metrics applied are EBITDA, earnings and revenue depending on the type of company. An increase in the portfolio’s share of NBID of DKK 100 million will affect the profit and loss account negatively by DKK 100 million, while a change in the LTM Metrics of 10% will affect the profit and loss account by around DKK 762 million.

The most subjective parameter in the valuation model is multiples estimated to be a reasonable proxy of markets multiples of comparable companies. The valuation multiples are set with reference to relevant market multiples and transaction multiples. If the valuation multiples used are changed by 1x, then it would have an impact in the comprehensive income statement of around DKK 733 million.

It is management’s assessment that the assumptions and estimates used are reasonable.

DKK (millions) 2022 2021 Investment Result Realised Gains & Losses for the Year, Net 525 96 Unrealised Value Adjustments, Net 1,221 1,209 Total Strategic Investments 1,746 1,305 Invested Capital Investment in Portfolio Companies at Fair Value 6,181 4,239 Investment Properties 20 20 Other Investments 0 34 Total Strategic Investments 6,201 4,293

03 47 Annual Report Financial Statements

Financial Investments 04

Accounting policy

Financial Investments is a portfolio of financial assets managed by Kirk Kapital Fondsmæglerselskab A/S who invest the portfolio to maximise the risk-adjusted return.

Financial assets categorised as Financial Investments are recognised in accordance with IFRS 9 at fair value through statement of comprehensive income. Investments are initially recognised at fair value and subsequently adjusted to fair value. Dividends received from investments are included in value adjustments.

Costs directly attributable to Financial Investments are allocated to the comprehensive income as realised gains and losses.

Financial Investments are classified as non-current assets since they are considered a long-term investment portfolio. DKK 1,566 million is estimated to be realisable within three months.

48 Annual Report Financial Statements

Significant accounting estimates and judgements

Financial Investments are measured at fair value using either level one or level three in the fair value hierocracy. Fixed income and equities are based on observable market data, and are thus level one. Alternatives are based on valuations of net asset value provided by external portfolio managers, and are thus level three.

Management and Kirk Kapital Fondsmæglerselskab A/S are continually monitoring the external portfolio managers and evaluating valuations.

Please refer to note 6 for further information on Market Risk.

DKK (millions) 2022 2021 Investment Result Realised Gains & Losses for the Year, Net (185) 42 Unrealised Value Adjustments, Net 25 316 Total Financial Investments (160) 358 Invested Capital Cash & Cash Equivalents 100 59 Fixed Income 347 332 Equities 854 1,162 Alternatives 992 958 Total Financial Investments 2,294 2,511

04 49 Annual Report Financial Statements

Vejle Investments

Accounting policy

Vejle Investments are defined as illiquid majority investments within the Vejle area.

The subsidiary Kirk Property A/S contains two investments: Fjordenhus, which is Kirk Kapital’s domicile, and investment properties through Kirk Property A/S’s subsidiary Havneøen 1 P/S.

Kirk Property A/S (excluding Havneøen 1 P/S) is recognised and measured under the equity method – the proportionate share of the net asset values. Fjordenhus is measured at cost less accumulated depreciation and impairment losses.

Investment properties (either owned directly or through subsidiaries) are measured at cost comprising

the acquisition price and costs of acquisition. The cost of self-constructed investment properties comprises the acquisition price and expenses directly related to the acquisition, including costs of acquisition and indirect expenses for labour, materials, components, and sub suppliers up until the time when the asset is ready for use. Investment properties constructed for sale are held at cost less impairments if market value is lower than costs. Investment properties constructed to lease are, after initial recognition, measured at fair value.

Non-current receivables are measured at amortised cost. Other equity investments are recognised and measured under the equity method, which is at the proportionate share of the net asset values.

Significant accounting estimates and judgements

Investment properties at fair value are net of any asset-backed finance. The gross value of Investment Properties at fair value is DKK 282 million. Investment properties at fair value consist of rental properties together with forest and agriculture land. Geographically the properties are located either in Vejle or in the vicinity of Vejle.

Investment properties are measured at fair value using level three in the fair value hierocracy, by either obtaining an external valuation report or using capitalisation models. Such models are based on assumption on future rent levels, vacancy levels, operating and maintenance costs, and yield requirements, and thus contain a number of accounting estimates.

05

50 Annual Report Financial Statements

Buildings valued using a capitalisations model are measured at an average rate of return of 5.3% to 6.1%. The average rate of return used is based on an assessment of locations, usage, and condition. An increase in the rate of return of 0.5% will impact the value of rental property negatively by approx. DKK 17 million before tax.

Fair value of the forest and agriculture land is estimated at DKK 115,000 per hectare (2021: 115,000 per hectare). A change of the price per hectare of 1% will impact the value of the forest and agriculture land by approx. DKK 0.6 million before tax.

It is management’s assessment that the assumptions and estimates used are reasonable.

DKK (millions) 2022 2021 Investment Result Realised Gains & Losses for the Year, Net 0 (1) Unrealised Value Adjustments, Net 18 (93) Total Vejle Investments 18 (94) Invested Capital Fjordenhus 237 220 Investment Properties, Fair Value 95 66 Investment Properties, Cost 64 49 Non Current Receivables 12 12 Other Equity Investments 20 30 Total Vejle Investments 429 377 05 51 Annual Report Financial Statements

06

Financial Risk Management

Financial risk factors

The company’s financial risk exposure is mainly centred around its Strategic Investments and Financial Investments. Financial risk management is managed individually for each investment category by the Strategic Investments team and Kirk Kapital Fondsmæglerselskab A/S. Overall risk analysis is performed in connection with setting the company’s investment strategy and capital allocation, which is discussed with and approved by the board.

The company’s financial risk profile is mainly dominated by market risk, where the company has high exposure to security prices and long-term equity market movements. The company has moderate exposure to interest rates and currency rates. To a lesser extent, the company is also exposed to credit risk and liquidity risk.

Derivatives financial instruments are mainly used to reduce financial risk exposure. Where all relevant cri-

teria are met, hedge accounting is applied to remove the accounting mismatch between the hedging instrument and the hedged item. This will effectively result in recognising interest expense at a fixed interest rate for the hedged floating rate loans or contracts and investment in foreign currency at the fixed foreign currency rate for the hedged investments.

For hedges of net investments in foreign currencies and financial assets denominated in foreign currencies, the company enters into hedge relationships where the critical terms of the hedging instrument match exactly with the terms of the hedged item. The company therefore performs a qualitative assessment of effectiveness. Under the company’s policy the critical terms of the forwards must align with the hedged items.

Market risk

Share price risk

A portion of the company’s Financial Investments assets is directly exposed to short-term movements in

security prices since DKK 854 million is listed equities and valued using observable prices on stock-exchanges. 10% in short-term negative movement in stock prices would affect the portfolio negatively with 11.1% in the short term corresponding to DKK 95 million.

Strategic Investments at fair value

DKK 6,181 million and alternatives under Financial Investments of DKK 992 million are measured at fair value using non-observable data, but data which to some extent is related to long-term market conditions. While these investments are thus not directly exposed to short-term stock price movement, there remains risk related to long-term market movements.

Foreign exchange risk

The company’s currency exposure can be divided into two categories of exposure and risks.

52 Annual Report Financial Statements

One category is investments denominated in currencies other that DKK/EUR. As per 31 December 2022, investments denominated in currency other than DKK/EUR amount to DKK 1,392 million and the exposure is mainly related to USD and NOK. Derivatives are used to hedge some of the currency risk in USD and the net exposure is reduced to DKK 1,179 million. The overall hedging rate is 15%, per 31 December 2022. The duration of the hedging contracts has a total maturity of less than three months following the end of the reporting period.

A change of 10% in exchange rates other than DKK/ EUR would have a short-term effect on the total comprehensive income by DKK 118 million.

The second category is the underlying currency risk in any investment regardless of exchange rate denomination where the investments are operating in a global market. Some of the investments are subject to currency exposure due to imbalances in revenue and expenses generated in foreign currencies mostly related to USD.

The risk is managed by the portfolio companies and fund managers and evaluated by the Strategic Investments team and Kirk Kapital Fondsmæglerselskab A/S.

Interest rate risk

The company’s interest exposure can be divided into three categories of exposure and risks.

The first category is interest rate risk related to the company’s debt instruments of DKK 547 million. An increase in interest rate of 1% would negatively affect other financials with 1% corresponding to DKK 5 million.

The second category is interest rate risk related to the company’s fixed income investments of DKK 347 million. An increase in interest of 1% would negatively affect the fixed income investments with 3.4% corresponding to DKK 12 million.

The third category is the underlying interest rate risk of debt instruments in the underlying investments

in each investment category. The risk is managed by the portfolio companies and fund managers which is evaluated by the Strategic Investments team and Kirk Kapital Fondsmæglerselskab. In terms of Vejle Investments the interest rate risk is handled by management. Debt instruments amount to DKK 450 million. An increase in interest rate of 1% would positively affect the Vejle Investments with 2.2% corresponding to DKK 10 million.

Credit risks

The company’s primary credit exposure is related to fixed income investments, financial instruments and cash positions. Major single exposures are either exposures to counterparts with good credit ratings and/or other supporting security measures in place. The overall credit risk is considered low.

Liquidity risk

The company manages its liquidity risk by continuously monitoring and assessing the liquidity positions.

06 53 Annual Report Financial Statements

Based on the relatively liquid Financial Investments and relatively low level of borrowings and liabilities the liquidity risk is considered low.

Maturity analysis

The table collates the company’s financial liabilities in relevant maturity groupings based on the remaining period at the balance sheet date and contractual maturity date. The amounts disclosed in the table are the contractual undiscounted cash flows.

Fair value of debt correspond approximately to amortised cost of debt.

Maturity Analysis - Liabilities DKK (millions) Less than 1 Year Between 1 and 5 Years More than 5 Years Total 2022 Non-Derivatives: Credit Institutions 547 0 0 547 Trade Payables 1 0 0 1 Lease Liabilities 3 13 50 66 Other Payables 37 50 180 267 Total Liabilities as of 31.12.2022 588 63 230 881 2021 Non-Derivatives: Credit Institutions 146 0 0 146 Lease Liabilities 3 12 54 69 Other Payables 153 50 50 253 Total Liabilities as of 31.12.2021 302 62 104 468

06

54 Annual Report Financial Statements

Measurement and fair value hierarchy

Measurement and fair value hierarchy is specified under each investment: please refer to note 3 (‘Strategic Investments’), note 4 (‘Financial Investments’) and note 5 (‘Vejle Investments’).

Financial Assets per Measurement Category DKK (millions) 2022 2021 Financial Assets at Fair Value: Strategic Investments 6,201 4,293 Financial Investments 2,294 2,511 Vejle Investments 95 66 Financial Assets at Amortised Costs: Non Current Receivables 12 12 Other Loans & Receivables 8 7 Cash & Cash Equivalents 0 1 Financial Liabilities per Measurement Category DKK (millions) 2022 2021 Financial Liabilities at Amoritised Costs: Lease Liabilities 66 69 Credit Institutions 547 146 Other Payables 268 253

06 55 Annual Report Financial Statements

07 DKK (millions) Note 2022 2021 Expenses Profit & Loss 185 158 Expenses Related to Subsidiaries (2) (5) Expenses Kirk Kapital 183 153 Staff Expenses 8 158 125 Other External Expenses & other Operating Expenses 25 28 Expenses Kirk Kapital 183 153 56 Annual Report Financial Statements

Expenses

Staff Expenses 08

Accounting policy

Staff expenses comprise wages, salaries, social security contributions, leave and sick leave, bonuses and non-monetary employee benefits and are recognised in the year in which the services are rendered. Whenever Kirk Kapital provides long-term employee benefits, the costs are aggregated to match the rendering of the services by the employees.

Key management compensation

Executive Management only consists of one member whereas the remuneration of the Executive Management and the Board of Directors is disclosed collectively with reference to §98b (3) of the Danish Financial Statements.

Incentive plans comprise a short-term incentive plan based on yearly performance and a long-term incentive plan related to long-term goals regarding value creation. Remuneration of key management amounts to DKK 86 million in 2022 and DKK 70 million in 2021 .

DKK (millions) 2022 2021 Wages & Salaries 155 122 Pensions & Other Staff Expenses 3 3 Total Staff Expenses 158 125 Average Number of Employees 20 20 57 Annual Report Financial Statements

Tax 09

Accounting policy

The company is jointly taxed with Danish Group companies and acts as the administrative company. The Danish income tax payable is allocated between the jointly taxed Danish companies based on their proportion of taxable income (full absorption including reimbursement of tax deficits). The jointly taxed companies are taxed under the Danish Tax Payment Scheme. Additions, deductions and allowances are recognised under financial income or financial costs.

The income tax expense or credit for the period is the tax payable on the current period’s taxable income

based on the applicable income tax rate for each jurisdiction adjusted by changes in deferred tax assets and liabilities attributable to temporary differences and to unused tax losses.

Deferred income tax assets are recognised only to the extent that it is probable that future taxable profit will be available, against which the temporary differences can be utilised.

58 Annual Report Financial Statements

Income Tax Expense DKK (millions) 2022 2021 Tax Comprehensive Income (40) 64 Tax Related Subsidiaries & Associated 7 13 Total Tax Kirk Kapital (33) 77 Breakdown of Total Tax: Current Tax on Comprehensive Income for the Year (36) 89 Current Tax on Comprehensive Income for Previous Years 3 (7) Deferred Tax for the Year & Previous Years 0 (5) Total Tax Kirk Kapital (33) 77 Income Tax are Specified as Follows DKK (millions) 2022 2021 Calculated 22.0% Tax on Comprehensive Income for the Year Before Tax 312 312 Tax Effects of: Income from Strategic Investments (Subsidaries & Associates) (375) (273) Income from Vejle Investments (Subsidaries & Associates) (3) (21) Adjustment from Previous Years 3 (7) Other 29 24 Total Tax Kirk Kapital (33) 77 Effective Tax Rate (2%) 5% 09 59 Annual Report Financial Statements

Related Parties 10

Kirk Kapital’s related parties comprise Casper Kirk Johansen, Marianne Fyhring Johansen, Anders Kirk Johansen and close famlily members together with the Board of Directors and the Executive Management of Kirk Kapital. Related parties also comprise subsidiaries. Related parties further comprise companies where the mentioned shareholders have significant influence: Selmont A/S, M.Kirk A/S, A.Kirk A/S, Pil & Birk Holding A/S, C2 A/S, CKKJ Cosmo ApS, JKJ Cosmo ApS, Edith & Godtfred Kirk Christiansens Fond and subsidiaries.

As major shareholders, Casper Kirk Johansen and Anders Kirk Johansen have significant influence in Kirk Kapital.

In the financial year, a limited number of transactions related to services took place between Kirk Kapital and its owners and between Kirk Kapital and its subsidaries. These services were paid on normal market terms.

There were no transactions with the Board of Directors or the Executive Management besides transactions related to employment.

For information about remuneration to the Board of Directors and the Executive Management, see note 8.

60 Annual Report Financial Statements

No other year-end balances or transactions have taken place during the year with the Board of Directors, the Executive Management, shareholders or other related parties.

DKK (millions) 2022 2021 Transactions with Related Parties: Subsidiaries Administration & Management Fee Income 48 35 Administration & Management Fee Expenses 6 6 Rental Expenses 4 4 Intercompany Interest Income 6 1 Intercompany Interest Expenses 0 2 Other Related Parties Administration & Management Fee Income 3 3 Salaries 86 70 DKK (millions) 2022 2021 Year-End Balances Arising from Transactions with Related Parties: Subsidiaries Receivables included in the balance sheet under: Strategic Investments 103 0 Vejle Investments 31 0 Receivables 134 0 Payables included in the balance sheet under: Strategic Investments 9 94 Vejle Investments 0 1 Payables 9 95 Other Related Parties Receivables 3 3 Payables 174 81 10 61 Annual Report Financial Statements

Share Capital 11

Accounting policy

Ordinary shares are classified as equity. Incremental costs directly attributable to the issue of new shares are shown in equity as a deduction, net of tax, from the proceeds.

Proposed dividends are disclosed as a separate item under equity and recognised as a liability when declared.

All shares have nominal value of DKK 1.

There have been no changes in the share capital during the last 5 years.

Each A share has 10 votes at the annual general meeting. Each B share has 1 vote at the annual general meeting.

The Share Capital Comprise Number of Shares Nominal Value (%) A Shares 57,709,000 58 B Shares 42,291,000 42 Share Capital 100,000,000 100 62 Annual Report Financial Statements

12

Commitments & Contingent Liabilities

Contingent liabilities

Remaining commitments regarding participation in investment projects amount to a maximum of DKK 897 million.

Security has been given in investment properties at a net carrying amount of DKK 61 million for the mortgage loans.

Kirk Kapital has provided a guarantee of a maximum of DKK 412 million to financial institutions in which the company’s subsidiaries and associates have loans and other engagements.

Kirk Kapital has entered into a cash pool agreement. As per 31 December 2022 the net withdrawl on the cashpool aregreement was DKK 163m.

Joint taxation scheme

Kirk Kapital and its Danish group companies are jointly and severally liable for tax on the jointly taxed incomes, etc. Kirk Kapital is the administrative company of the joint taxation. Kirk Kapital and its Danish group companies are jointly and severally liable for the joint taxation liability. The joint taxation liability covers income taxes and withholding taxes on dividends, royalties and interest.

63 Annual Report Financial Statements

Investments in Subsidiaries & Accociates

13 64 Annual Report Financial Statements

Subsidiaries

*Financial Statements are presented in USD, which is the functional currency of the company.

Name Place of Registered Office Share Capital DKK (millions) Votes Ownership

Kirk Kapital Strategic Investments A/S Vejle, Denmark 100.0 100% 100% Kirk Kapital Fondsmæglerselskab A/S Vejle, Denmark 1.4 100% 100% KIRK Farm A/S Vejle, Denmark 0.5 100% 100% KIRK Shipping A/S* Vejle, Denmark 0.5 100% 100% Gunhild Kirk A/S* Vejle, Denmark 0.5 100% 100% Edith Kirk A/S* Vejle, Denmark 0.5 100% 100% Marie Kirk A/S* Vejle, Denmark 1.5 100% 100% Marianne Kirk A/S* Vejle, Denmark 0.5 100% 100% Anja Kirk A/S* Vejle, Denmark 0.5 100% 100% KIRK Aviation A/S* Vejle, Denmark 10.0 57% 40% KKAG Komplementarselskab ApS* Vejle, Denmark 0.1 57% 40% KA1 P/S* Vejle, Denmark 3.2 57% 40% KN Operating Ltd.* Dublin, Ireland 0.0 57% 40% KIRK Property A/S Vejle, Denmark 0.6 100% 100% Havneøen 1 P/S Vejle, Denmark 0.4 100% 100% Komplementarselskabet Havneøen 1 ApS Vejle, Denmark 0.1 100% 100% KIRK Suites ApS Vejle, Denmark 0.0 100% 100% Associates: K/S Høje-Taastrup Bredsten, Denmark 18.0 19% 19% Høje-Taastrup ApS Bredsten, Denmark 0.1 19% 19% Virumgårdsvej 17 ApS Virum, Denmark 0.5 50% 50%

13 65 Annual Report Financial Statements

Appointed

14 DKK (millions) 2022 2021 Audit Fee 0 0 Tax Advisory Services 0 1 Non-Audit Services 0 0 Total Auditors Fee 1 1 66 Annual Report Financial Statements

Fees to Auditors

at the General Meeting

Events after the Balance Sheet Date 15

No events materially affecting the assessment of the Annual Report have occurred after the balance sheet date.

67 Annual Report Financial Statements

Management’s Statement

The Board of Directors and the Executive Board have today considered and approved the annual report of Kirk Kapital A/S for the financial year 1 January – 31 December 2022.

The Annual Report has been prepared in accordance with International Financial Reporting Standards as adopted by the EU, and further requirements in the Danish Financial Statements Act.

In our opinion, the financial statements give a true and fair view of the company’s financial position at 31 December 2022 and of the results of their operations and

cash flows for the financial year 1 January – 31 December 2022.

In our opinion, the management commentary contains a fair review of the development of the company’s business and financial matters, the results for the year and of the company’s financial position, together with a description of the principal risks and uncertainties that the company faces.

We recommend the Annual Report for adoption at the annual general meeting.

68 Annual Report Financial Statements

Vejle, 25 April 2023

Executive Management

Kim Gulstad

Board of Directors

Casper Kirk Johansen, Chairman

Anders Kirk Johansen

Peter Beske Nielsen

Birgitte Nielsen

Jens Winther Moberg

69 Annual Report Financial Statements

Independent Auditor’s Report

To the shareholders of Kirk Kapital A/S Opinion

We have audited the fi nancial statements of Kirk Kapital A/S for the fi nancial year 01.01.2022 - 31.12.2022, which comprise the income statement, statement of comprehensive income, balance sheet, statement of changes in equity, cash flow statement and notes, including a summary of signi ficant accounting policies. The fi nancial statements are prepared in accordance with International Financial Reporting Standards as adopted by the EU and additional requirements of the Danish Financial Statements Act.

In our opinion, the fi nancial statements give a true and fair view of the company’s fi nancial position at 31.12.2022 and of the results of its operations and cash flows for the fi nancial year 01.01.2022 - 31.12.2022 in accordance with International Financial Reporting Standards as adopted by the EU and additional requirements of the Danish Financial Statements Act.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (ISAs) and additional requirements applicable in Denmark. Our responsibilities under those standards and requirements are further described in the “Auditor’s responsibilities for the audit of the fi nancial statements” section of this auditor’s report. We are independent of the company in accordance with the International Ethics Standards Board for Accountants’ International Code of Ethics for Professional Accountants (IESBA Code) and the additional ethical requirements applicable in Denmark, and we have ful fi lled our other ethical responsibilities in accordance with these requirements and the IESBA Code. We believe that the audit evidence we have obtained is su fficient and appropriate to provide a basis for our opinion.

Statement on the management commentary

Management is responsible for the management commentary.

Our opinion on the fi nancial statements does not cover the management commentary, and we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the management commentary and, in doing so, consider whether the management commentary is materially inconsistent with the financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated.

Moreover, it is our responsibility to consider whether the management commentary provides the information required under the Danish Financial Statements Act.

Based on the work we have performed, we conclude that the management commentary is in accordance with the fi nancial statements and has been prepared in accordance with the requirements of the Danish Financial Statements Act. We did not identify any material misstatement of the management commentary.

Management’s responsibilities for the fi nancial statements

Management is responsible for the preparation of fi nancial statements that give a true and fair view in accordance with International Financial Reporting Standards as adopted by the EU and additional requirements of the Danish Financial Statements Act, and for such internal control as Management determines is necessary to enable the preparation of fi nan-

70 Annual Report Financial Statements

cial statements that are free from material misstatement, whether due to fraud or error.

In preparing the fi nancial statements, Management is responsible for assessing the company’s ability to continue as a going concern, for disclosing, as applicable, matters related to going concern, and for using the going concern basis of accounting in preparing the fi nancial statements unless Management either intends to liquidate the company or to cease operations, or has no realistic alternative but to do so.

Auditor’s responsibilities for the audit of the fi nancial statements

Our objectives are to obtain reasonable assurance about whether the fi nancial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs and the additional requirements applicable in Denmark will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to in fluence the economic decisions of users taken on the basis of these fi nancial statements.

As part of an audit conducted in accordance with ISAs and the additional requirements applicable in Denmark, we exercise professional judgement and maintain

professional scepticism throughout the audit. We also:

• Identify and assess the risks of material misstatement of the fi nancial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is su fficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

• Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the e ffectiveness of the Entity’s internal control.

• Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by Management.

• Conclude on the appropriateness of Management’s use of the going concern basis of accounting in preparing the fi nancial statements, and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast signi ficant doubt on the company’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw

attention in our auditor’s report to the related disclosures in the fi nancial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the company to cease to continue as a going concern.

• Evaluate the overall presentation, structure and content of the financial statements, including the disclosures in the notes, and whether the financial statements represent the underlying transactions and events in a manner that gives a true and fair view.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and signi ficant audit fi ndings, including any signi ficant de ficiencies in internal control that we identify during our audit.

Aarhus, 25 April 2023

Deloitte

Statsautoriseret Revisionspartnerselskab

CVR No. 33963556

Thomas Rosquist Andersen

State Authorised Public Accountant

Identi fication No (MNE) mne31482

Søren Marquart Alsen

State Authorised Public Accountant

Identi fication No (MNE) mne40040

71 Annual Report Financial Statements

2022

ESG Report

05 ESG 78 Letter from CEO 82 Kirk Kapital’s ESG Framework 83 ESG within Investment Activities 85 Strategic Investments 86 Financial Investments 88 Inside Kirk Kapital ESG Report 2022 04 Financial Statements 36 Comprehensive Income Statement 37 Balance Sheet Statement 38 Changes in Equity Statement 39 Cash Flow Statement 40 Notes 68 Management’s Statement 70 Independent Auditor’s Report 02 Our Business Activities 18 Activities Overview 20 Strategic Investments 24 Financial Investments 26 Vejle Investments 28 Business & Financial Risk 03 Board & Management Composition 32 Board of Directors & Executive Management 01 Introduction 08 Our Heritage 08 What We Do 12 2022 at a Glance 14 Financial Highlights Annual Report 2022

05 ESG

Letter from the CEO

Kim Gulstad CEO

Kim Gulstad CEO

Kirk Kapital’s purpose is to create long-term prosperity for our shareholders, partners, and employees. Prosperity, in our view, is about much more than wealth creation. It is also about ensuring well-being in a broader context. Our ambition is therefore also to do our part in helping to build a better world.

Our heritage and legacy from LEGO, and a solid set of family-based values, have ensured that Kirk Kapital has always acted with a high degree of integrity, responsibility, and honour. Today, these values can be categorised as ESG.

In 2021, Kirk Kapital issued its first ESG Report which was a first important step towards our more formalised approach to ESG. I am happy to issue our second report in 2022, and comment on the important progress we have made.

78 ESG Report ESG

We want to inspire

Kirk Kapital intends to showcase responsible behaviour in everything we do, both when it comes to investing our capital and within our own organisation.

With our capital, we want to exhibit responsible ESG behaviour with the objective of increasing risk-adjusted investment returns. Due to our defined investment strategy, and limited size in a global context, Kirk Kapital cannot dictate a specific ESG agenda within our investments. However, we can positively select investments, and we can encourage and inspire others to act responsibly. Furthermore, our ESG voice is more convincing if we also apply our ESG principles internally, which is what we have set out to do.

This is why Kirk Kapital wants to lead by example, and proactively inspire external stakeholders to make sustainable ESG changes.

Our sustainability commitment

Kirk Kapital joined the UN Global Compact in 2021, and we have since been committed to doing business responsibly and according to the ten principles of human rights, labour, environment, and anti-corruption. With this letter, we are expressing our continued support for the UN Global Compact and renewing our ongoing commitment to the initiative.

In 2021, Kirk Kapital also selected four UN Sustainable Development Goals (SDG), which we focus on internally. These are: 5. Gender equality; 8. Decent work and economic growth; 13. Climate action; and finally, 16: Peace, justice, and strong institutions. The structured focus on these areas has yielded early positive results, as described in this ESG Report.

This year, Kirk Kapital has initiated the mapping of our CO₂ footprint. This will provide us with a transparent overview of our current negative CO₂ footprint, and where the main negative contributions come from. This, in turn, will better enable us to prioritise our CO₂ reduction initiatives, and tackle SDG item 13.

The ESG Report 2022

This report serves as our annual communication on progress (CoP) as a signatory to the UN Global Compact, and as our reporting on underrepresented gender in management, data ethics and Corporate Social Responsibility.

79 ESG Report ESG

80 ESG Report ESG

“ With our capital, we want to exhibit responsible ESG behaviour with the objective of increasing risk-adjusted investment returns.”

Kim Gulstad, CEO

81 ESG Report ESG

ESG Compass

Ki rk K apit al E SG Compa ss

Co ns is ti ng of four pillars:

Screenin g & Al ig nment

ESG Integr ation

Acti ve O wnersh ip & Eng agem ent

Sustaina ble Development & Impact

UN Global Compac t

10 princip les wi thin four themes : Huma n ri ghts

Labour

Envi ronment

Anti -c or ru pt ion

UN Sus tain able Development Go al s

17 goals – w ith our main focus on:

Ge nder e qual it y

Dece nt work and economic g rowt h

Clim ate action

Peace, jus tice, and stro ng ins titutions

ESG Framework

The UN Global Compact and the four SDGs highlight the themes we focus on. As reported last year, we have devised a tool that we call the Kirk Kapital ESG Compass, which helps determine how we will work with sustainability.

Our ESG Compass consists of four pillars: Screening & Alignment; ESG Integration; Active Ownership & Engagement; and Sustainable Development & Impact. Through our ESG Compass and our commitment to both the UN Global Compact and the four chosen SDGs, we want to inspire companies to take responsibility. Not just because it is a part of our legacy and heritage, but also because it is the core of Kirk Kapital’s values and purpose.

82 ESG Report ESG

Kirk Kapital’s

ESG Compass

ESG within Investment Activities

Kirk Kapital’s main investment activities consist of our Strategic Investments and our Financial Investments (see chapter 1 & 2 of this report for further information about our business model). Within Strategic Investments, we acquire larger minority shareholdings (25-49%) in companies while applying an active ownership agenda through board representation. Within Financial Investments, Kirk Kapital manages multiple individual portfolios, where each portfolio is tailored to our partners’ precise requirements and wishes. The portfolios consist of a wide range of investments including fixed income, listed equities and alternatives.

While the activities of our two main investment activities are different in nature, we have devised a common ESG Compass strategy, which is the main framework for our ESG approach. Hence, this serves as the main framework for our ESG approach with regards to our main investment activities.

83 ESG Report ESG

84 ESG Report ESG

Strategic Investments

As the investment strategy is to conduct larger minority shareholdings, Kirk Kapital cannot dictate a specific ESG agenda within our investments. However, we can positively select investments, and we can encourage and inspire others to act responsibly. This is our ESG strategy, and our activities are aligned to fulfil this strategy.

ESG is an integral part of the due diligence process

As a standard requirement prior to all new potential investments, a specific ESG diligence is conducted in connection with the due diligence. We adopt a dynamic sustainability materiality framework in order to assess key ESG factors relevant to the company and the industry in which it operates.

Our sustainability due diligence process consists of four steps: 1. Identify material ESG topics; 2. Request ESG information and documentation from the target; 3. Q&A session; and 4. ESG Due Diligence Report.

Five sustainability criteria have been defined: 1. Well-defined ESG management and resources; 2. Alignment with UN Global Compact principles; 3. Implemented material sustainability initiatives and KPIs; 4. Contribution to UN SDGs; and 5. Limited ESG risk exposure. These will be assessed, and a score will be concluded, which will lead to an overall sustainability score. The overall sustainability score is included in our overall investment recommendation.

In 2022, we carried out ESG due diligence process in connection with new potential investments. All reviews were concluded satisfactory, providing us with a clear overview of each company’s total sustainability score.

ESG Board Engagement Policy

The objective of the ESG Board Engagement Policy is to govern how Kirk Kapital representatives take an active role on the boards of our Strategic Investments portfolio companies.